Commercial Real Estate Market Statistics: A Summary of 2016 and a Look Toward 2017

2016 was a hot market year for Commercial Real Estate. Thousands of new jobs were created that are having a dynamic impact on our industry and consumer spending continues to rise.

2017 is looking bright as we head into the New Year, and we are excited to see continued growth from business investments, exports, reconstruction and supply chains.

Here’s a brief look back into 2016 and a projection of what’s to come in 2017.

2016

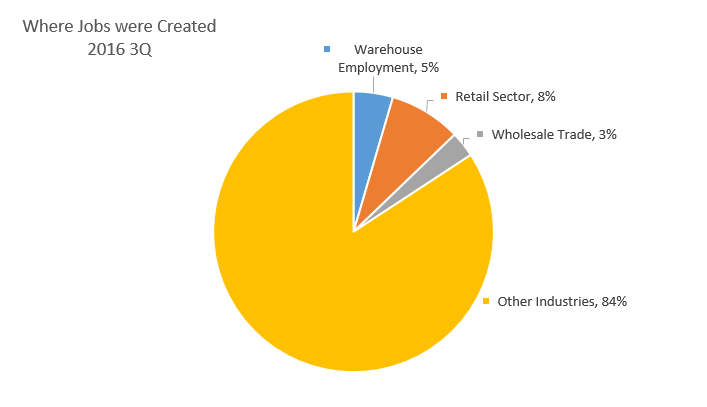

- Third quarter results show that personal consumer spending rose at an annual rate of 2.1 percent. Most of the spending was on goods and services.

- Export activity increased, which means that companies are coming closer to their goal of serving global markets.

- Business investments are up by 5.4 percent. Owners are interested in growing their businesses and are willing to take more monetary risks right now.

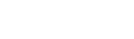

- 619,000 jobs were created. Of those, 28,100 were in warehouse employment. The retail sector added 51,200 jobs and the wholesale trade industry gained 18,300 jobs.

- Demand for industrial properties rose, while older properties such as malls and community centers often remained empty.

- Office and retail space building and leasing remain stagnant as business owners are turning their attention to industrial space.

2017

- The national unemployment rate is under 5 percent. This will allow companies to be more profitable since they have enough workers to commit to their production lines and run their office operations. Low unemployment rates also benefit every other industry because these individuals will keep buying goods and services, in turn, balancing out the old economic scale of supply versus demand.

- There will be a small increase in the need for apartments and senior housing as millennials and baby boomers seek to settle into properties that are not single family dwellings.

- An increase in the need for retail and office space is expected, as business owners take more risks and add products and services to their offerings.

- Investor spending by business owners located outside of the U.S. is expected to increase due to the low lending rates and new opportunities afforded them in this country.

- Old malls and dated commercial properties will be re-purposed, turning into classrooms, last mile supply warehouses, expanding city government offices, and possibly new places for entertainment such as kid’s play zones, bowling alleys, and other family-oriented entertainment centers.

- Lower energy prices will continue to be a factor as companies are able to spend less on operations and more on bringing products and services into an area.

Although 2017 seems brighter, there is still work to be done in each community in order to fully restore economic prosperity. Gaughan Companies is excited for these new opportunities, and we look forward to working with you to meet all of your commercial real estate needs.

-Patrick Gaughan

Why Manufacturing Growth Affects Everyone

According to studies compiled by Markit Economics, U.S. manufacturing is down for the months of August and September. The recent news of Brexit and the fact that China has reached a slump in their economy is causing slower manufacturing and spending around the world. The U.S. is only at a two percent growth rate for the year.

Minimum wage earnings are down for Americans compared with where they were about fifteen years ago, and the hiring trends by companies have also slowed. If Americans can’t spend, the economy can’t grow.

Economists have estimated that the average age that it takes to double the standard of living for the average American is now up to about seventy years. This inability to change one’s circumstances within a short amount of time has led to the baby boomers not having enough to retire on, so a lot of them go back to work. However, due to their age, they are usually stuck in dead end jobs that pay very little.

Young people who would ordinarily be graduating college, then landing that first job, buying that first home, and starting their family, are now moving back into their parents’ basements in droves. If they are lucky enough to land a great job, they are not getting great offers that the grads of twenty years ago did. In addition, the Federal Reserve is starting to increase interest rates, which makes it harder to purchase homes and automobiles.

There are several things in development here in the U.S. that are also causing our economy to be sluggish in growth. It doesn’t help that the unrest and attacks overseas have caused Americans to think twice or pause for longer periods of time before booking long awaited vacations to foreign countries. So the travel and tourism industries are suffering. In turn, those countries that might ordinarily have great products or services to export, may be suffering from a lack of workers and facilities because of war and civil unrest.

It also doesn’t help that we are all waiting on the results of the Presidential Election. The fiscal policies, public investment and structural reform that the new President will put into place will greatly affect our economy and cause ripple effects around the world.

The U.S. manufacturing companies are watching all of this unfold around them. With the advancement of the ease of deliveries, many Americans are using their purchasing power to order from overseas companies who are marketing cheap products and sometimes lesser quality to Americans who want to get the most for their dollar.

This in turn affects local suppliers who have slowed in their production times because the orders are not coming in. Many of them prefer to make items in bulk quantities, so they are hesitant to fire up the assembly lines and employ workers who many not have much to work on. The U.S. manufacturers are also hesitant to have a lot of inventory laying around, especially those who work in food services, because they know there is a shelf life to their product. They don’t want to have it still sitting in their warehouse when it’s close to expiration.

The U.S. dollar is strong right now too, and even though some countries are catering to Americans, others can’t afford to. This lessens the global demand for U.S. goods and services. However, it is estimated that nearly half of all U.S exports go to countries that we have free trade agreements with. Also, when the U.S. plants do fire up their assembly lines, it is estimated that they use about thirty percent of the nation’s energy supply in order to run their operation. So, that is good for the energy industry.

No one knows what the answer is to get the world economy moving again. Several theories have been tried and discarded. The only thing that seems to make sense is for industry leaders to invest in better training for their employees, study the competition abroad, increase funding for STEM related fields, and find ways to make great products at affordable prices.